Turnover is high in our industry and Dolr has given us the edge to stay ahead and provide the consistent and quality care our clients are accustomed to. Implementing the benefit across all of our facilities was simple and the support from the Dolr team has been remarkable.

Lonnie H., Vice President Human Resources

at company with 1,500 employees

Companies love Dolr

Because their employees love Dolr

Recruit

89% of job seekers choose a job offering student loan benefits over an alternative

Retain

54% increased retention across key roles when student loan benefits are offered

Engage

75% of workers say student loan benefits would increase their commitment to their employer

Include

66% of student debt is held by women. Black women have the highest student debt levels after graduation

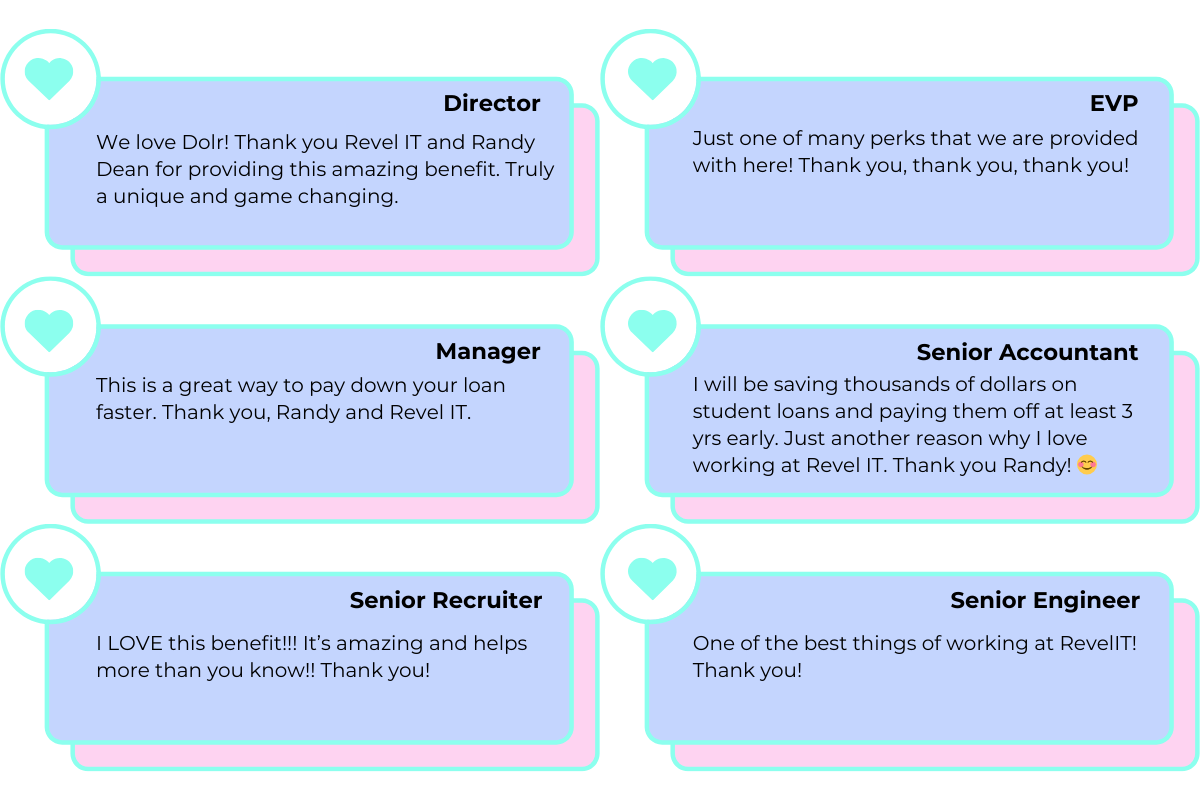

Employees love Dolr

because Dolr drives real outcomes

Debt free sooner

They’re out of debt in half the time saving thousands in loan and interest payments

Extra payments

With Dolr, student loan repayment is a team effort. They get cash from multiple sources for extra student loan payments

Instant gratification

Student debt is an urgent concern. Dolr accelerates them to $0 student debt.

Impactful. Powerful. Simple.

Launch in a day. It's a no-brainer.

- Add your TeamWith 200+ payroll integrations you can simply integrate Dolr into your existing processes

- Choose your programCreate a flexible and customizable program to fit your unique needs with the guidance of a student loan benefits specialist

- LaunchDolr handles onboarding, enrollment, loan verifications, and payments to both Federal and private student loans

Dolr integrates with 200+ Payroll & HRIS providers

Our pricing promise

Our automated systems reduce costs. And we pass those savings on to you.

Average annual cost to company for participating employees

$18,750

average annual cost of turnover and backfilling roles (based on national averages)Without Dolr

$2,390

total annual cost of student loan benefits with Dolr including all contributions and fees less any impact and tax savingsWith Dolr see details

Amounts shown are estimates, offer no guarantees, and may change.

Dolr supports diverse Companies at all stages

Build flexible student loan benefits programs from two simple building blocks.

Adaptive by design.

Fixed monthly contributions

Give your Team a fixed monthly contribution to their student loan payments every month

Giving the gift of Tenure

Give your Team contributions that increase over time. A great way to reward tenure

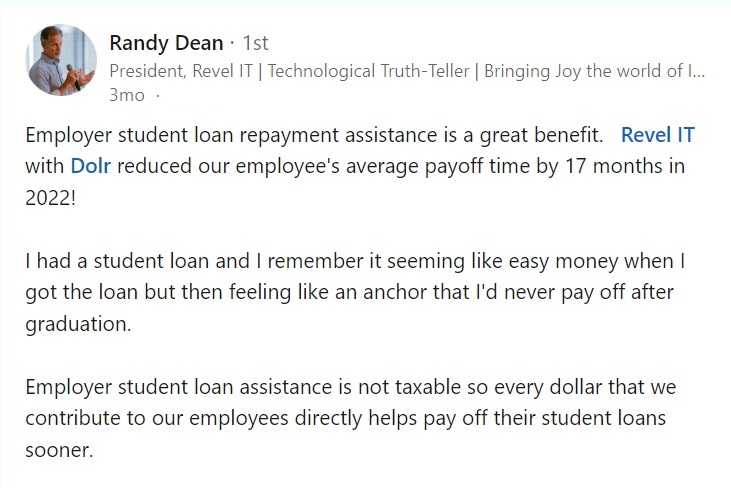

Public displays of affection

This post on LinkedIn. The incredible response from employees.

That’s Dolr.