- Compare, enroll, re-certifyTake the guesswork out of choosing Federal student loan repayment plans. Employees compare plans, enroll, and handle annual certifications all in one place with Dolr

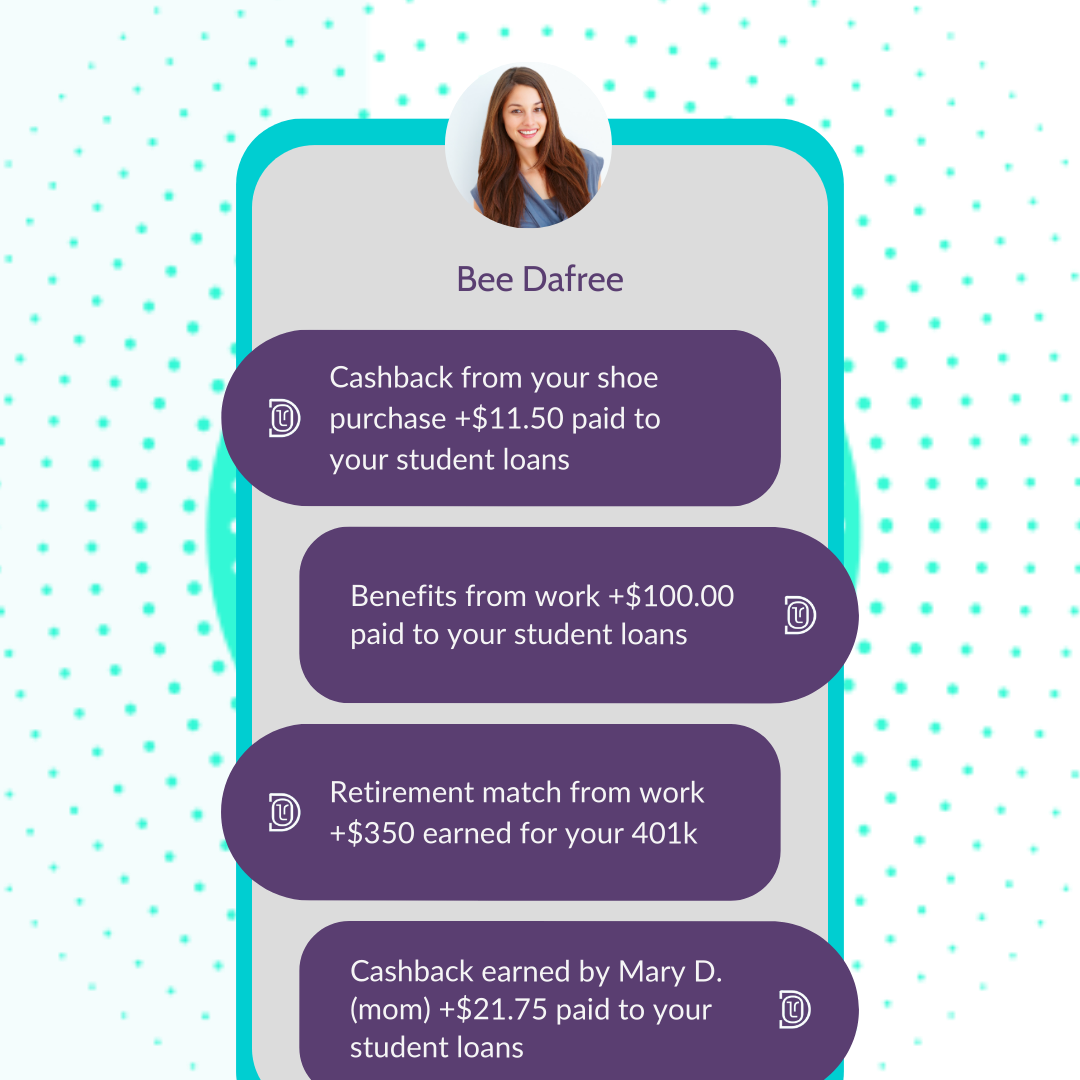

- Cashback for paymentsMake their money work for them. They can shop at hundreds of Brands partnered with Dolr and earn cashback paid directly to student loans. With Dolr every-day purchases beat their student debt

- CommunityTheir Village of friends and family can gift employees cashback when they shop at hundreds of Brands partnered with Dolr. Employees leverage community to beat debt

Student loan review, support, & found money.

Getting Dolr from work means getting multiple sources of extra cash for student loan payments. Employees getting Dolr save 4 years of repayment and tens of thousands of dollars.

It's better than a $5,250 raise

Your company can contribute up to $5,250 tax-free paid to employee student loans every year. Employees don't get taxed on that money. It all goes to their student loan payments.

Your company gets a tax-deduction* too. That means you pay less in taxes* by helping your employees with their student loans.

*This is not tax advice. Consult your tax partner for specifics of your situation

Secure Act 2.0 enabled retirement matching

Thanks to new laws (Secure Act 2.0) your company can put money in employee retirement accounts to match their student loan payments.

They pay their student loans. You match* those payments to their retirement account. Example: they pay $500 to student loans & the Company matches $500 to 401k.

*How much and how often you match depends on your retirement plan and program.

Tuition reimbursement without the headache

What if you could offer more people tuition reimbursement? What if they didn't leave as soon as the claw-back period expired? What if you didn't have to worry about tracking grades?

Our first of its kind program lets you offer Tuition Reimbursement without the complex contracts and high-cost. Help your employees upskill with Dolr.