It's better than a $5,250 raise

Your company can give you up to $5,250 tax-free paid to your student loans every year. Yep, you don't get taxed* on that money. It all goes to your student loan payments.

Oh, they get a tax-deduction* too. That means they pay less in taxes by helping you with your student loans.

*This is not tax advice. Ask your HR or Benefits leadership for details relevant to your company and circumstances. Or have them reach out to us.

Save more for retirement by paying your student loans

Thanks to new laws (Secure Act 2.0) your company can put money in your retirement account to match your student loan payments.

You pay your student loans. They match* those payments to your retirement account. Example: you pay $500 to student loans & they put $500 in your 401k.

*How much and how often they match depends on your retirement plan and company.

- Compare, enroll, re-certifyTake the guesswork out of choosing Federal student loan repayment plans. Compare plans, enroll, and handle your annual certifications all in one place with Dolr

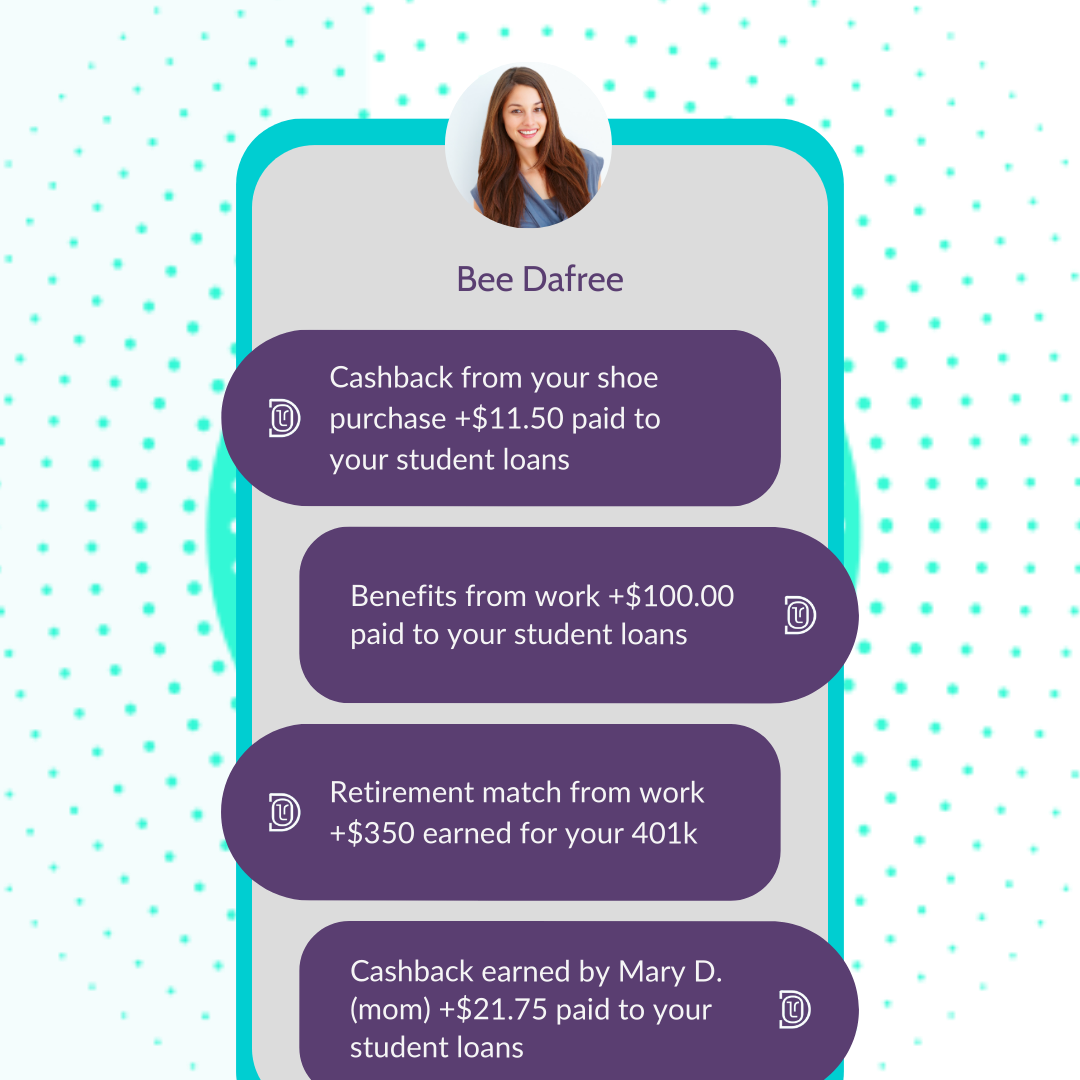

- Get cash back for paymentsMake your money work for you. Shop at hundreds of Brands partnered with Dolr and earn cashback paid directly to your student loans. Swipe your card and watch every-day purchases beat your student debt

- Build your movementGet your Village of friends and family to gift you their cashback when they shop at hundreds of Brands partnered with Dolr. They swipe and your loans get paid